UK inflation rate unexpectedly rises to 10.4% – what it means for your money | The Sun

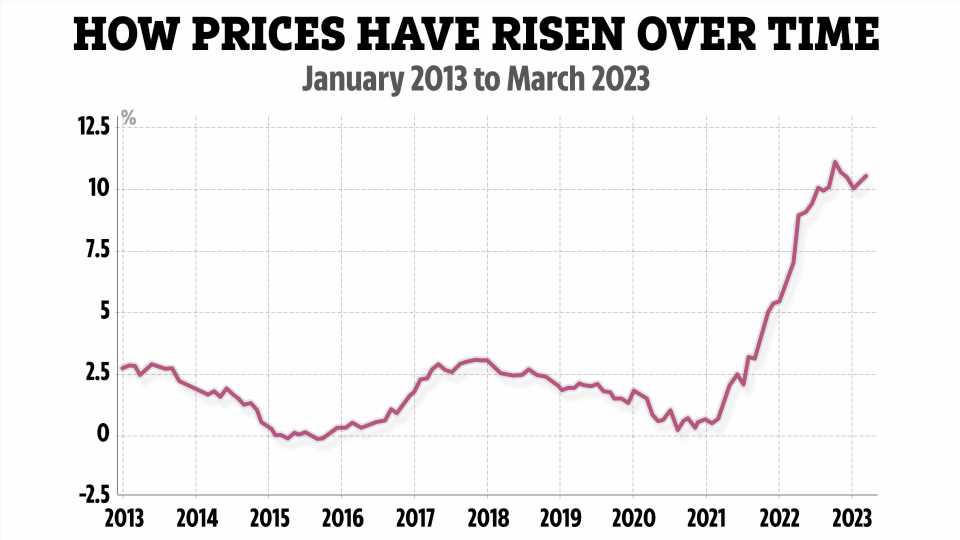

03/22/2023THE UK’s rate of inflation has risen to 10.4% in February, in another blow to households

The rate rose in from 10.1% in January, according to the Office for National Statistics (ONS).

This ended up being higher than the 9.9% that was predicted by the Bank of England and economists polled by Reuters.

Higher household energy bills, food and alcoholic beverages were the biggest driver of inflation last month.

The rate of inflation had been steadily falling for the three months prior to February.

It meant prices were still rising but at a slower rate.

Read more in money

What is inflation and what is the current rate?

UK set to avoid recession this year and inflation WILL halve, Hunt reveals

The rate of inflation fell further than many experts predicted last month – with previous forecasts suggesting it would hit 10.2% in January.

However, the Office for Budget Responsibility expects inflation to drop to 2.9% by the end of the year.

ONS chief economist Grant Fitzner said: “Inflation ticked up in February, mainly driven by rising alcohol prices in pubs and restaurants following discounting in January.

“Food and non-alcoholic drink prices rose to their highest rate in over 45 years with particular increases for some salad and vegetable items as high energy costs and bad weather across parts of Europe led to shortages and rationing.

Most read in Money

Martin Lewis gives warning to millions ahead of next month's mobile bill hikes

Mars makes BIG change to Galaxy bars – and people are furious

McDonald's adds FIVE new items to their menu – including return of fan favourite

B&M to close three stores within days- is your branch going?

“These were partially offset by falls in the cost of motor fuel, where the annual inflation rate has eased for seven consecutive months.”

Inflation is the measurement of how much goods and services are worth in a given period.

This means how much the price of goods, such as food or televisions, and services, such as haircuts or train tickets, has changed over time.

The rise comes as the Bank of England is expected to announce new interest rates tomorrow.

The BoE has been hiking interest rates in a bid to tackle soaring inflation.

Increasing interest rates makes borrowing on home loans and credit cards more expensive, but it is meant to bring down inflation by encouraging people to save rather than spend.

Chancellor of the Exchequer, Jeremy Hunt said: “Falling inflation isn’t inevitable, so we need to stick to our plan to halve it this year.

"We recognise just how tough things are for families across the country, so as we work towards getting inflation under control we will help families with cost of living support worth £3,300 on average per household this year."

What does it mean for my money?

Alice Haine, personal finance analyst at BestInvest, said: "Rising inflation delivers a fresh blow to households that were hoping the financial squeeze was finally starting to ease."

"It means disposable incomes are still very much under threat when you consider the additional challenges posed by higher mortgage costs, falling real incomes, looming tax rises and the prospect that the Bank of England may hike interest rates for the 11th time in a row tomorrow."

"But a rise in inflation coupled with the recent turmoil in the banking sector is raising a fresh set of challenges for the Bank of England, which must now decide whether to push ahead with a widely expected 25 basis point rate hike or put their monetary tightening plans on pause until the banking turbulence passes.

"If the decision is to pause, this could mean inflation stays high for longer as workers benefit from end of tax year pay rises and, for the lucky ones, bonuses too."

However, falling inflation indicates that the cost of goods and services are still rising but at a slower rate.

But prices are still higher than they were.

Food and drink prices rose by 16.9% in the 12 months to December 2022, up from 16.5% in November.

Experts believe the slowdown in the rate of inflation is unlikely to stop the Bank of England from hiking interest rates once more at its meeting in March.

The move will make the cost of borrowing, including loans, credit cards and mortgage repayments more expensive.

Although it's good news for savers as they may get better rates on their nest egg.

What is inflation?

Inflation is a measure of how much goods and services are worth in a given period.

This means how much the price of goods, such as food or televisions, and services, such as haircuts or train tickets, has changed over time.

It is known as a "backward looking measure", which means it indicates what has happened over the past year.

That obviously means it does not predict the future.

Read More on The Sun

McDonald’s adds FIVE new items to their menu – including return of fan favourite

Mum slammed for giving her 7-month-old ‘Jeremy Kyle’ version of baby led weaning

The rate of inflation is published each month by the Office for National Statistics (ONS).

It's a non-ministerial department which reports directly to Parliament.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected]

Source: Read Full Article